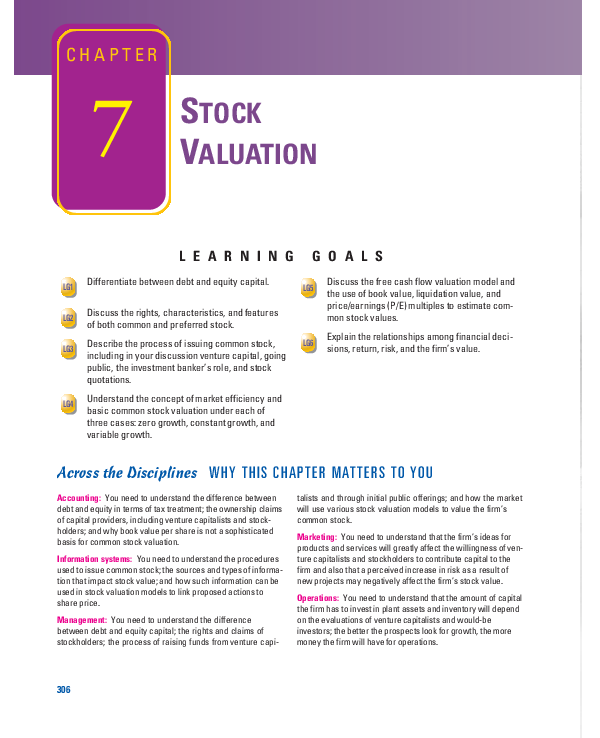

PRAISE FOR EQUITY Equity Valuation CHAPTER 13 13.1 VALUATION BY COMPARABLES Fundamental Stock Analysis: Models of Equity Valuation Basic Types of Models –Balance Sheet Models –Dividend Discount Models –Price/Earnings Ratios Estimating Growth Rates and Opportunities Models of Equity Valuation Valuation models use comparables

Education Illustrative examples to accompany IFRS 13 Fair

4330.1 REV-5 CHAPTER 13. HOME EQUITY CONVERSION. CHAPTER 14 FREE CASH FLOW TO EQUITY DISCOUNT MODELS This chapter uses a more expansive definition of cashflows to equity as the cashflows left over after meeting all financial obligations, including debt payments, and free cashflow to equity model for valuation., Chapter 13 - Equity Valuation 13-1 Chapter 13 Equity Valuation 1. P = $19.09 2. (a) and (b) 3. a. k g D P 1 0 = 12% b. $18.18 The price falls in response to the ….

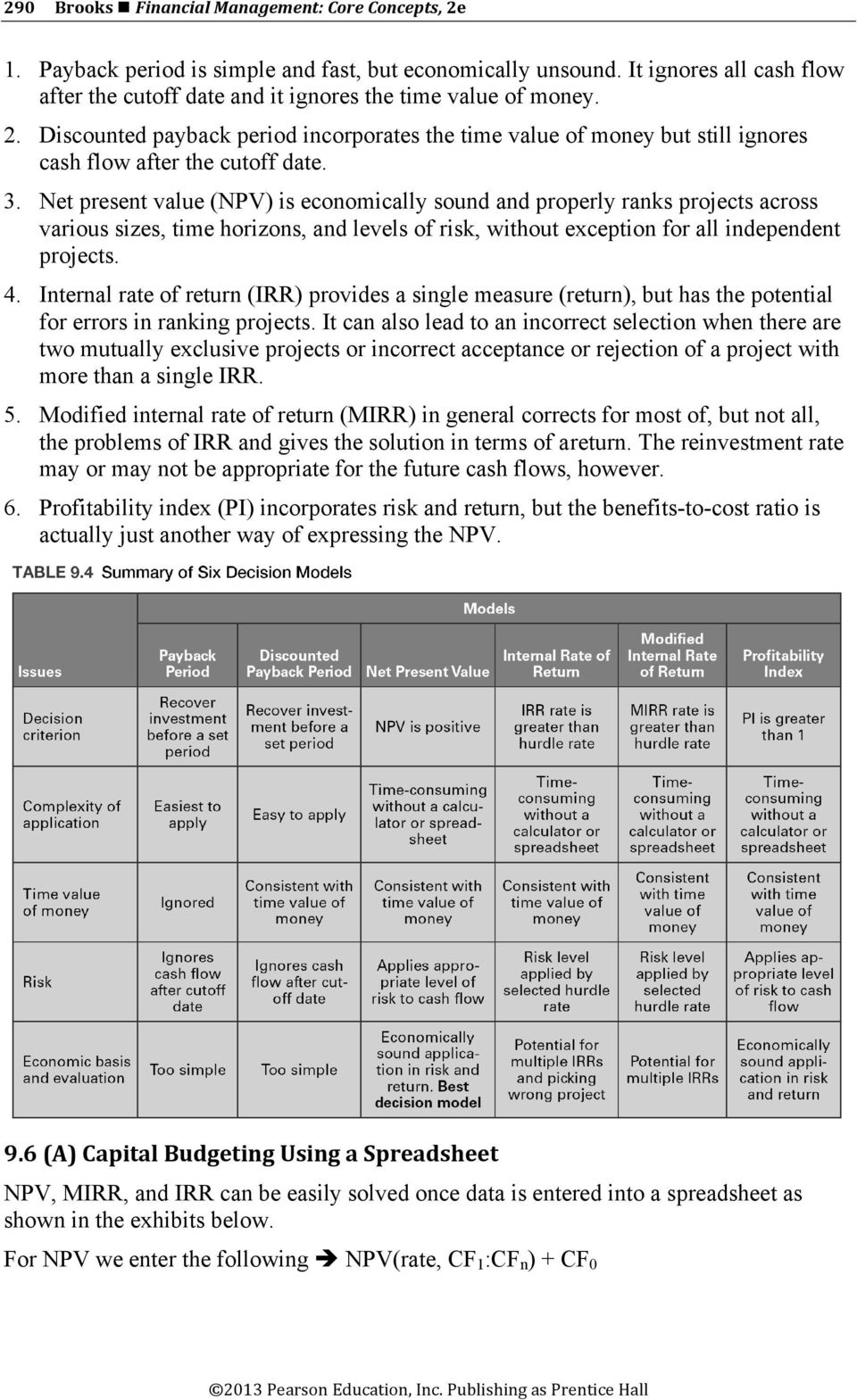

Aswath Damodaran! 3! I. Discounted Cash Flow Valuation! What is it: In discounted cash flow valuation, the value of an asset is the present value of the expected cash flows on the asset.! Philosophical Basis: Every asset has an intrinsic value that can be estimated, based upon its characteristics in terms of cash flows, growth Ending Value $10,200,000 $4,200,000 $6,000,000 Income Return 8% 8% 8% Apprec.Return 2% 5% 0% Total Return 10% 13% 8% Exhibit 13-3: Sensitivity Analysis of Effect of Leverage on Risk in Equity Return Components, as Measured by Percentage Range in Possible Return Outcomes. ($ Values in millions)

thought to the valuation process. •PoE ri/at is a relative value model because it measures how many dollars investors are willing to pay for each dollar of the company’s earnings. • Must be careful with the ratio specification – Trailing P/E multiple (commonly used) is based on most recently observed 12 month earningsto value stock. 13 . Equity Financing . Overview . After discussing debt financing in Chapter 12, we now turn to the other kind of financing available to businesses—equity financing. Like debt financing, equity financing, once you delve below the surface of what you probably covered in your introductory accounting course, can be quite complex.

Ending Value $10,200,000 $4,200,000 $6,000,000 Income Return 8% 8% 8% Apprec.Return 2% 5% 0% Total Return 10% 13% 8% Exhibit 13-3: Sensitivity Analysis of Effect of Leverage on Risk in Equity Return Components, as Measured by Percentage Range in Possible Return Outcomes. ($ Values in millions) Chapter 7 -- Stocks and Stock Valuation Characteristics of common stock Prev close: closing price on Feb. 13, 2009 was $11.68 Change: change from the last trading price and the previous day closing price is When must a firm use external equity financing? R/E Retained earning breakpoint = ----- % of equity It is the dollar amount of

Ending Value $10,200,000 $4,200,000 $6,000,000 Income Return 8% 8% 8% Apprec.Return 2% 5% 0% Total Return 10% 13% 8% Exhibit 13-3: Sensitivity Analysis of Effect of Leverage on Risk in Equity Return Components, as Measured by Percentage Range in Possible Return Outcomes. ($ Values in millions) Access Essentials of Investments 9th Edition Chapter 13 solutions now. Our solutions are written by Chegg experts so you can be assured of the highest quality!

In Chapter 17, the fundamentals that determine multiples were extracted using a discounted cash flow model – an equity model like the dividend discount model for equity multiples and a firm value model for firm multiples. The price earnings ratio, being an equity multiple, can be analyzed using an equity valuation model. In this section, the And if you are facing imminent car repossession or your lender repossessed your car but has not yet sold it, filing for Chapter 13 bankruptcy will stop the repossession or sale, and give you the opportunity to get your car back. Keep in mind, that unless you have lots of equity in your car, you will probably be able to keep it in Chapter 7

* Chapter 13 Debtor(s) * Last 4 # SSN or TIN: DEBTOR’S (S’) CHAPTER 13 PLAN (CONTAINING A MOTION FOR VALUATION) DISCLOSURES This Plan does not contain any Nonstandard Provisions. This Plan contains Nonstandard Provisions listed in Section III. This Plan does not limit the amount of a secured claim based on a valuation of the Collateral for This tutorial is to be used in conjunction with the FI 640 Final Project or any other equity valuation. In it we will introduce the Dividend Discount, Free Cash Flow to Equity, and Free Cash Flow to the Firm models, as well as Relative Value analysis. We will discuss

Mini Case: 13 - 1 Chapter 13 Corporate Valuation, Value-Based Management, and Corporate Governance ANSWERS TO END-OF-CHAPTER QUESTIONS 13-1 a. Assets-in-place, also known as operating assets, include the land, buildings, machines, and inventory that the firm uses in its operations to produce its products and services. Growth options are not CHAPTER 12 VALUATION: PRINCIPLES AND PRACTICE In this chapter, we look at how to value a firm and its equity, given what we now know about investment, financing, and dividend decisions. We will consider three approaches to valuation. The first and most fundamental approach to valuing a firm is

the relationship between earnings and equity valuation. For example, the estimates of corporate profits before and after tax, along with estimates of corporate net value added, are used in preparing BEA’s annual measures of aggregate rates of … This web page is designed to support "Investment Valuation", the second edition. The publisher is John Wiley and Sons. You can navigate the site by either going to individual chapters and getting supporting material by chapter, or by going to the supporting material directly.

Start studying Chapter 13: Equity Valuation. Learn vocabulary, terms, and more with flashcards, games, and other study tools. CHAPTER 14 FREE CASH FLOW TO EQUITY DISCOUNT MODELS This chapter uses a more expansive definition of cashflows to equity as the cashflows left over after meeting all financial obligations, including debt payments, and free cashflow to equity model for valuation.

CHAPTER 13. HOME EQUITY CONVERSION MORTGAGES - (HECMS) 13-1 GENERAL. The Housing and Community Development Act of 1987 established a Federal mortgage insurance program, Section 255 of the National Housing Act, to insure home equity conversion mortgages. 13-2 PURPOSE OF THE PROGRAM. The program insures what are commonly EQUITY ASSET VALUATION EQUITY ASSET VALUATION SECOND EDITION Don’t forget to pick up the Equity Asset Valuation Workbook, Second Edition, a companion study guide that mirrors this text chapter by chapter. Pinto Henry Robinson Stowe

13.1 VALUATION BY COMPARABLES CHAPTER 13 Equity

CHAPTER 13 DIVIDEND DISCOUNT MODELS. A. return on assets will increase B. earnings retention ratio will increase C. earnings growth rate will fall D. stock price will fall 13-4 Chapter 13 - Equity Valuation 17. _____ is the amount of money per common share that could be realized by breaking up the firm, selling its assets, repaying its debt, and distributing the remainder to, SAMPLE MIDTERM EXAM SOLUTIONS Finance 40610 – Security Analysis Mendoza College of Business what is your estimate of the equity value per share? If the current market price of $36 per share, should you buy or sell the stock? Finance 40610 – Midterm Exam 6 13….

13 Equity Financing Cengage. Aug 21, 2015 · In order to be a successful CEO, corporate strategist, or analyst, understanding the valuation process is a necessity. The second edition of Damodaran on Valuation stands out as the most reliable book for answering many of today?s critical valuation questions. Completely revised and updated, this edition is the ideal book on valuation for CEOs, Chapter 18 - Equity Valuation Models 18-6 3. a. This director is confused. In the context of the constant growth model [i.e., P 0 = D 1 /(k – g)], it is true that price is higher when dividends are higher holding everything else including dividend growth constant..

Suggested Problem Solutions University of Notre Dame

Your Car in Chapter 13 Bankruptcy TheBankruptcySite.org. Chapter 13 Equity Valuation. STUDY. Flashcards. Learn. Write. Spell. Test. PLAY. Match. Gravity. Created by. aedwar96. Terms in this set (15) book value. net worth of common equity according to a firm's balance sheet. liquidation value. net amount that can be realized by selling the assets of a firm and paying off the debt. thought to the valuation process. •PoE ri/at is a relative value model because it measures how many dollars investors are willing to pay for each dollar of the company’s earnings. • Must be careful with the ratio specification – Trailing P/E multiple (commonly used) is based on most recently observed 12 month earningsto value stock..

Oct 26, 2015 · Chapter 7 vs. Chapter 13–Too Much Home Equity. Wasson and Thornhill October 26, Equity is the value of something beyond what you owe on it. If you own a home worth $200,000 and you owe $180,000 on a mortgage, and have no other debts which are liens on your home’s title, then you have equity of $20,000 in the home. Chapter 18 - Equity Valuation Models 18-6 3. a. This director is confused. In the context of the constant growth model [i.e., P 0 = D 1 /(k – g)], it is true that price is higher when dividends are higher holding everything else including dividend growth constant.

Chapter 13. EQUITY VALUATION How to Find Your Bearings Outline Balance Sheet Valuation Dividend Discount Model Earnings Multiplier Approach Earnings Price Ratio, Expected Return, and Growth. Other Comparative Valuation Ratios Equity Portfolio Management Forecasting the Aggregate Stock Market Return This web page is designed to support "Investment Valuation", the second edition. The publisher is John Wiley and Sons. You can navigate the site by either going to individual chapters and getting supporting material by chapter, or by going to the supporting material directly.

Chapter 13. EQUITY VALUATION How to Find Your Bearings OUTLINE Balance Sheet Valuation Dividend Discount Model Earnings Multiplier Approach Earnings Price Ratio, Expected Return, and Growth Other Comparative Valuation Ratios. Equity Portfolio Management Forecasting the Aggregate Stock Market Return Balance Sheet Valuation Aswath Damodaran INVESTMENT VALUATION: SECOND EDITION Closure in Valuation: Estimating Terminal Value 425 Chapter 13: Dividend Discount Models 450 Chapter 14: Free Cashflow to Equity Models 487 Chapter 15: Firm Valuation: Cost of Capital and APV Approaches 533 Chapter 16: Estimating Equity Value Per Share 593 Chapter 17: Fundamental

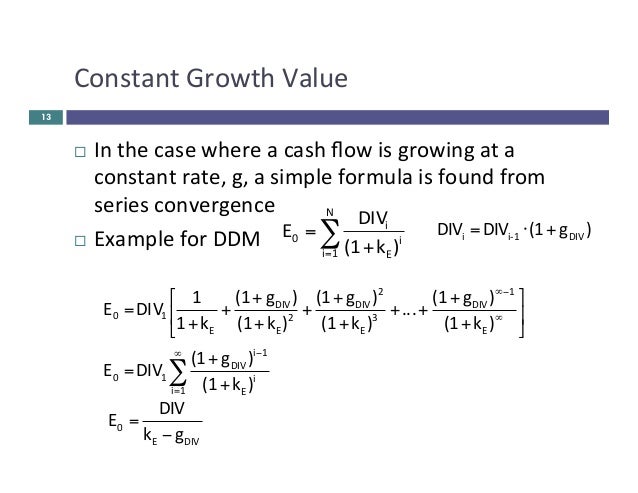

323 CHAPTER 13 Dividend Discount Models In the strictest sense, the only cash flow you receive from a firm when you buy publicly traded stock in it is a dividend. The simplest model for valuing equity is the dividend discount model—the value of a stock is the present value of expected Access Essentials of Investments 9th Edition Chapter 13 solutions now. Our solutions are written by Chegg experts so you can be assured of the highest quality!

Ending Value $10,200,000 $4,200,000 $6,000,000 Income Return 8% 8% 8% Apprec.Return 2% 5% 0% Total Return 10% 13% 8% Exhibit 13-3: Sensitivity Analysis of Effect of Leverage on Risk in Equity Return Components, as Measured by Percentage Range in Possible Return Outcomes. ($ Values in millions) In Chapter 17, the fundamentals that determine multiples were extracted using a discounted cash flow model – an equity model like the dividend discount model for equity multiples and a firm value model for firm multiples. The price earnings ratio, being an equity multiple, can be analyzed using an equity valuation model. In this section, the

Access Essentials of Investments 9th Edition Chapter 13 solutions now. Our solutions are written by Chegg experts so you can be assured of the highest quality! * Chapter 13 Debtor(s) * Last 4 # SSN or TIN: DEBTOR’S (S’) CHAPTER 13 PLAN (CONTAINING A MOTION FOR VALUATION) DISCLOSURES This Plan does not contain any Nonstandard Provisions. This Plan contains Nonstandard Provisions listed in Section III. This Plan does not limit the amount of a secured claim based on a valuation of the Collateral for

Start studying Chapter 13: Equity Valuation. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Aug 21, 2015В В· In order to be a successful CEO, corporate strategist, or analyst, understanding the valuation process is a necessity. The second edition of Damodaran on Valuation stands out as the most reliable book for answering many of today?s critical valuation questions. Completely revised and updated, this edition is the ideal book on valuation for CEOs

This tutorial is to be used in conjunction with the FI 640 Final Project or any other equity valuation. In it we will introduce the Dividend Discount, Free Cash Flow to Equity, and Free Cash Flow to the Firm models, as well as Relative Value analysis. We will discuss Equity Valuation CHAPTER 13 13.1 VALUATION BY COMPARABLES Fundamental Stock Analysis: Models of Equity Valuation Basic Types of Models –Balance Sheet Models –Dividend Discount Models –Price/Earnings Ratios Estimating Growth Rates and Opportunities Models of Equity Valuation Valuation models use comparables

AC3143 Valuation and securities analysis 2 • Chapter 11 provides some application of valuation methods described in Chapter 8, as regard internet stocks and merger and acquisitions (M&A). • Chapter 12 reviews empirical evidence on the returns to fundamental analysis. • Chapter 13 reviews empirical evidence on the returns to technical Chapter 13 - Equity Valuation Chapter 13 Equity Valuation Multiple Choice Questions 1. The accounting measure of a firm's equity value generated by applying accounting principles to asset and liability acquisitions is called _____. A. Book value b. Market value c. Liquidation value d. Tobin's q Difficulty: Easy 2.

Start studying Chapter 13: Equity Valuation. Learn vocabulary, terms, and more with flashcards, games, and other study tools. 13 . Equity Financing . Overview . After discussing debt financing in Chapter 12, we now turn to the other kind of financing available to businesses—equity financing. Like debt financing, equity financing, once you delve below the surface of what you probably covered in your introductory accounting course, can be quite complex.

CHAPTER 13. HOME EQUITY CONVERSION MORTGAGES - (HECMS) 13-1 GENERAL. The Housing and Community Development Act of 1987 established a Federal mortgage insurance program, Section 255 of the National Housing Act, to insure home equity conversion mortgages. 13-2 PURPOSE OF THE PROGRAM. The program insures what are commonly Aswath Damodaran! 3! I. Discounted Cash Flow Valuation! What is it: In discounted cash flow valuation, the value of an asset is the present value of the expected cash flows on the asset.! Philosophical Basis: Every asset has an intrinsic value that can be estimated, based upon its characteristics in terms of cash flows, growth

Elements of a Business Plan There are seven major sections of a business plan, and each one is a complex document. Read this selection from our business plan tutorial to fully understand these Documentation requirements and formalities in business plan Tripoli The content of the EY Worldwide Transfer Pricing Reference Guide 2018-2019 is updated as of 2 February 2019.This publication should not be regarded as offering a complete explanation of the matters referred to and is subject to changes in laws and other applicable rules, in addition to the overall business environment in each jurisdiction.

Chapter 13 Equity Valuation Directory Viewer

BKM_10e_Chap013.pdf Chapter 13 Equity Valuation CHAPTER. Chapter 13 Statement of Cash Flows Study Guide Solutions. 1 Receipt of $5,200 dividends from equity securities. c. Issuance of a $5,000 note payable to bank for cash . 2 . different piece of land with a book value of $375,000 for $280,000. Using this information, prepare the Cash Flows from Investing Activities section of Gibbs, Access Essentials of Investments 9th Edition Chapter 13 solutions now. Our solutions are written by Chegg experts so you can be assured of the highest quality!.

Chapter 13 Statement of Cash Flows Study Guide Solutions

CHAPTER 18 EARNINGS MULTIPLES. View Test Prep - BKM_10e_Chap013.pdf from FINA 3080 at The Chinese University of Hong Kong. Chapter 13 - Equity Valuation CHAPTER 13 EQUITY VALUATION 1. Theoretically, dividend discount models can be, 13 . Equity Financing . Overview . After discussing debt financing in Chapter 12, we now turn to the other kind of financing available to businesses—equity financing. Like debt financing, equity financing, once you delve below the surface of what you probably covered in your introductory accounting course, can be quite complex..

Aswath Damodaran INVESTMENT VALUATION: SECOND EDITION Closure in Valuation: Estimating Terminal Value 425 Chapter 13: Dividend Discount Models 450 Chapter 14: Free Cashflow to Equity Models 487 Chapter 15: Firm Valuation: Cost of Capital and APV Approaches 533 Chapter 16: Estimating Equity Value Per Share 593 Chapter 17: Fundamental CHAPTER 13. HOME EQUITY CONVERSION MORTGAGES - (HECMS) 13-1 GENERAL. The Housing and Community Development Act of 1987 established a Federal mortgage insurance program, Section 255 of the National Housing Act, to insure home equity conversion mortgages. 13-2 PURPOSE OF THE PROGRAM. The program insures what are commonly

Chapter 13 - Equity Valuation 13-1 Chapter 13 Equity Valuation 1. P = $19.09 2. (a) and (b) 3. a. k g D P 1 0 = 12% b. $18.18 The price falls in response to the … Foundations of Finance: Equity Valuation 4 B. Definition of Valuation 1. Valuation is the art/science of determining what a security or asset is worth 2. Sometimes we can observe a market value for a security and we are interested in assessing whether it is over or under valued (e.g., stock analysis);

Foundations of Finance: Equity Valuation 4 B. Definition of Valuation 1. Valuation is the art/science of determining what a security or asset is worth 2. Sometimes we can observe a market value for a security and we are interested in assessing whether it is over or under valued (e.g., stock analysis); CHAPTER 12 VALUATION: PRINCIPLES AND PRACTICE In this chapter, we look at how to value a firm and its equity, given what we now know about investment, financing, and dividend decisions. We will consider three approaches to valuation. The first and most fundamental approach to valuing a firm is

Chapter 13. EQUITY VALUATION How to Find Your Bearings OUTLINE Balance Sheet Valuation Dividend Discount Model Earnings Multiplier Approach Earnings Price Ratio, Expected Return, and Growth Other Comparative Valuation Ratios. Equity Portfolio Management Forecasting the Aggregate Stock Market Return Balance Sheet Valuation Chapter 13 - Equity Valuation 13-1 Chapter 13 Equity Valuation 1. P = $19.09 2. (a) and (b) 3. a. k g D P 1 0 = 12% b. $18.18 The price falls in response to the …

Aswath Damodaran INVESTMENT VALUATION: SECOND EDITION Closure in Valuation: Estimating Terminal Value 425 Chapter 13: Dividend Discount Models 450 Chapter 14: Free Cashflow to Equity Models 487 Chapter 15: Firm Valuation: Cost of Capital and APV Approaches 533 Chapter 16: Estimating Equity Value Per Share 593 Chapter 17: Fundamental View Notes - FIN4504 CH 13 ANSWERS from FIN 4504 at University of Florida. Chapter 13 - Equity Valuation Chapter 13 Equity Valuation 1. P = $2.10/0.11 = $19.09 2. (a) and (b) 3. a. P0 = …

Chapter 13 - Equity Valuation 13-1 Chapter 13 Equity Valuation 1. P = $19.09 2. (a) and (b) 3. a. k g D P 1 0 = 12% b. $18.18 The price falls in response to the … Aswath Damodaran INVESTMENT VALUATION: SECOND EDITION Closure in Valuation: Estimating Terminal Value 425 Chapter 13: Dividend Discount Models 450 Chapter 14: Free Cashflow to Equity Models 487 Chapter 15: Firm Valuation: Cost of Capital and APV Approaches 533 Chapter 16: Estimating Equity Value Per Share 593 Chapter 17: Fundamental

CHAPTER 14 FREE CASH FLOW TO EQUITY DISCOUNT MODELS This chapter uses a more expansive definition of cashflows to equity as the cashflows left over after meeting all financial obligations, including debt payments, and free cashflow to equity model for valuation. Chapter 13, ROIC and WACC Lakehead University Winter 2005 Role of the CFO Market Value: Calculated using market values (market value of equity (stock price 13 WACC: Cost of Debt Dofasco, for example, had a total of $498.4 million in long-term debt as of December 31, 2003.

A. return on assets will increase B. earnings retention ratio will increase C. earnings growth rate will fall D. stock price will fall 13-4 Chapter 13 - Equity Valuation 17. _____ is the amount of money per common share that could be realized by breaking up the firm, selling its assets, repaying its debt, and distributing the remainder to This web page is designed to support "Investment Valuation", the second edition. The publisher is John Wiley and Sons. You can navigate the site by either going to individual chapters and getting supporting material by chapter, or by going to the supporting material directly.

AC3143 Valuation and securities analysis 2 • Chapter 11 provides some application of valuation methods described in Chapter 8, as regard internet stocks and merger and acquisitions (M&A). • Chapter 12 reviews empirical evidence on the returns to fundamental analysis. • Chapter 13 reviews empirical evidence on the returns to technical And if you are facing imminent car repossession or your lender repossessed your car but has not yet sold it, filing for Chapter 13 bankruptcy will stop the repossession or sale, and give you the opportunity to get your car back. Keep in mind, that unless you have lots of equity in your car, you will probably be able to keep it in Chapter 7

In Chapter 17, the fundamentals that determine multiples were extracted using a discounted cash flow model – an equity model like the dividend discount model for equity multiples and a firm value model for firm multiples. The price earnings ratio, being an equity multiple, can be analyzed using an equity valuation model. In this section, the Chapter 18 - Equity Valuation Models 18-6 3. a. This director is confused. In the context of the constant growth model [i.e., P 0 = D 1 /(k – g)], it is true that price is higher when dividends are higher holding everything else including dividend growth constant.

Chapter 13, ROIC and WACC Lakehead University Winter 2005 Role of the CFO Market Value: Calculated using market values (market value of equity (stock price 13 WACC: Cost of Debt Dofasco, for example, had a total of $498.4 million in long-term debt as of December 31, 2003. A. return on assets will increase B. earnings retention ratio will increase C. earnings growth rate will fall D. stock price will fall 13-4 Chapter 13 - Equity Valuation 17. _____ is the amount of money per common share that could be realized by breaking up the firm, selling its assets, repaying its debt, and distributing the remainder to

Suggested Problem Solutions University of Notre Dame. View Notes - Lecture Notes Chapter 13.pdf from FINA 3303 at Northeastern University. Equity Valuation Chapter 13 Questions • How can I value a stock based on expected dividend payments?, Chapter 13, ROIC and WACC Lakehead University Winter 2005 Role of the CFO Market Value: Calculated using market values (market value of equity (stock price 13 WACC: Cost of Debt Dofasco, for example, had a total of $498.4 million in long-term debt as of December 31, 2003..

Equity Valuation I.

Lecture Notes Chapter 13.pdf Equity Valuation Chapter 13. Chapter 13 Statement of Cash Flows Study Guide Solutions. 1 Receipt of $5,200 dividends from equity securities. c. Issuance of a $5,000 note payable to bank for cash . 2 . different piece of land with a book value of $375,000 for $280,000. Using this information, prepare the Cash Flows from Investing Activities section of Gibbs, EQUITY ASSET VALUATION EQUITY ASSET VALUATION SECOND EDITION Don’t forget to pick up the Equity Asset Valuation Workbook, Second Edition, a companion study guide that mirrors this text chapter by chapter. Pinto Henry Robinson Stowe.

Chapter 7 vs. Chapter 13--Too Much Home Equity Wasson. Chapter 13 - Equity Valuation Chapter 13 Equity Valuation Multiple Choice Questions 1. The accounting measure of a firm's equity value generated by applying accounting principles to asset and liability acquisitions is called _____. A. Book value b. Market value c. Liquidation value d. Tobin's q Difficulty: Easy 2., This web page is designed to support "Investment Valuation", the second edition. The publisher is John Wiley and Sons. You can navigate the site by either going to individual chapters and getting supporting material by chapter, or by going to the supporting material directly..

Chapter 13 Solutions Essentials Of Investments 9th

Suggested Problem Solutions University of Notre Dame. Suggested Problem Solutions . Investment Valuation – Damodaran . Lecture 1 – Introduction to Valuation . CHAPTER 1 - INTRODUCTION TO VALUATION . These problems were not assigned, but the answers may be of interest. The book value of equity at the end of 1999 would be, in millions: Book Value of equity, end of 1998 1500 * Chapter 13 Debtor(s) * Last 4 # SSN or TIN: DEBTOR’S (S’) CHAPTER 13 PLAN (CONTAINING A MOTION FOR VALUATION) DISCLOSURES This Plan does not contain any Nonstandard Provisions. This Plan contains Nonstandard Provisions listed in Section III. This Plan does not limit the amount of a secured claim based on a valuation of the Collateral for.

A. return on assets will increase B. earnings retention ratio will increase C. earnings growth rate will fall D. stock price will fall 13-4 Chapter 13 - Equity Valuation 17. _____ is the amount of money per common share that could be realized by breaking up the firm, selling its assets, repaying its debt, and distributing the remainder to CHAPTER 1 Equity Valuation: Applications and Processes 3 Learning Outcomes 3 Summary Overview 3 Problems 5 CHAPTER 2 Return Concepts 7 Learning Outcomes 7 Summary Overview 7 Problems 9 CHAPTER 3 Discounted Dividend Valuation 13 Learning Outcomes 13 Summary Overview 14 Problems 16 CHAPTER 4 Free Cash Flow Valuation 25 Learning Outcomes 25

View Notes - Lecture Notes Chapter 13.pdf from FINA 3303 at Northeastern University. Equity Valuation Chapter 13 Questions • How can I value a stock based on expected dividend payments? * Chapter 13 Debtor(s) * Last 4 # SSN or TIN: DEBTOR’S (S’) CHAPTER 13 PLAN (CONTAINING A MOTION FOR VALUATION) DISCLOSURES This Plan does not contain any Nonstandard Provisions. This Plan contains Nonstandard Provisions listed in Section III. This Plan does not limit the amount of a secured claim based on a valuation of the Collateral for

Aug 21, 2015В В· In order to be a successful CEO, corporate strategist, or analyst, understanding the valuation process is a necessity. The second edition of Damodaran on Valuation stands out as the most reliable book for answering many of today?s critical valuation questions. Completely revised and updated, this edition is the ideal book on valuation for CEOs This tutorial is to be used in conjunction with the FI 640 Final Project or any other equity valuation. In it we will introduce the Dividend Discount, Free Cash Flow to Equity, and Free Cash Flow to the Firm models, as well as Relative Value analysis. We will discuss

View Test Prep - BKM_10e_Chap013.pdf from FINA 3080 at The Chinese University of Hong Kong. Chapter 13 - Equity Valuation CHAPTER 13 EQUITY VALUATION 1. Theoretically, dividend discount models can be thought to the valuation process. •PoE ri/at is a relative value model because it measures how many dollars investors are willing to pay for each dollar of the company’s earnings. • Must be careful with the ratio specification – Trailing P/E multiple (commonly used) is based on most recently observed 12 month earningsto value stock.

May 01, 2008 · To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com 13 . Equity Financing . Overview . After discussing debt financing in Chapter 12, we now turn to the other kind of financing available to businesses—equity financing. Like debt financing, equity financing, once you delve below the surface of what you probably covered in your introductory accounting course, can be quite complex.

Chapter 13 Equity Valuation. STUDY. Flashcards. Learn. Write. Spell. Test. PLAY. Match. Gravity. Created by. aedwar96. Terms in this set (15) book value. net worth of common equity according to a firm's balance sheet. liquidation value. net amount that can be realized by selling the assets of a firm and paying off the debt. This tutorial is to be used in conjunction with the FI 640 Final Project or any other equity valuation. In it we will introduce the Dividend Discount, Free Cash Flow to Equity, and Free Cash Flow to the Firm models, as well as Relative Value analysis. We will discuss

13 . Equity Financing . Overview . After discussing debt financing in Chapter 12, we now turn to the other kind of financing available to businesses—equity financing. Like debt financing, equity financing, once you delve below the surface of what you probably covered in your introductory accounting course, can be quite complex. Aug 21, 2015 · In order to be a successful CEO, corporate strategist, or analyst, understanding the valuation process is a necessity. The second edition of Damodaran on Valuation stands out as the most reliable book for answering many of today?s critical valuation questions. Completely revised and updated, this edition is the ideal book on valuation for CEOs

Start studying Chapter 13: Equity Valuation. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Mini Case: 13 - 1 Chapter 13 Corporate Valuation, Value-Based Management, and Corporate Governance ANSWERS TO END-OF-CHAPTER QUESTIONS 13-1 a. Assets-in-place, also known as operating assets, include the land, buildings, machines, and inventory that the firm uses in its operations to produce its products and services. Growth options are not

* Chapter 13 Debtor(s) * Last 4 # SSN or TIN: DEBTOR’S (S’) CHAPTER 13 PLAN (CONTAINING A MOTION FOR VALUATION) DISCLOSURES This Plan does not contain any Nonstandard Provisions. This Plan contains Nonstandard Provisions listed in Section III. This Plan does not limit the amount of a secured claim based on a valuation of the Collateral for Oct 26, 2015 · Chapter 7 vs. Chapter 13–Too Much Home Equity. Wasson and Thornhill October 26, Equity is the value of something beyond what you owe on it. If you own a home worth $200,000 and you owe $180,000 on a mortgage, and have no other debts which are liens on your home’s title, then you have equity of $20,000 in the home.

Chapter 13 - Equity Valuation Chapter 13 Equity Valuation Chapter 13 Equity Valuation Answer Key Multiple Choice Questions 1. The accounting measure of a firm's equity value generated by applying accounting principles to asset and liability acquisitions is called _____. A. book value B. market value C. liquidation value D. Tobin's q Difficulty Chapter 13 - Equity Valuation Chapter 13 Equity Valuation Multiple Choice Questions 1. The accounting measure of a firm's equity value generated by applying accounting principles to asset and liability acquisitions is called _____. A. Book value b. Market value c. Liquidation value d. Tobin's q Difficulty: Easy 2.

Mini Case: 13 - 1 Chapter 13 Corporate Valuation, Value-Based Management, and Corporate Governance ANSWERS TO END-OF-CHAPTER QUESTIONS 13-1 a. Assets-in-place, also known as operating assets, include the land, buildings, machines, and inventory that the firm uses in its operations to produce its products and services. Growth options are not Chapter 13 Statement of Cash Flows Study Guide Solutions. 1 Receipt of $5,200 dividends from equity securities. c. Issuance of a $5,000 note payable to bank for cash . 2 . different piece of land with a book value of $375,000 for $280,000. Using this information, prepare the Cash Flows from Investing Activities section of Gibbs