Trade finance PwC Trade Finance Global can help unlock Working Capital from your Trade Cycles and free up Cash Flow, if your business trades Goods, Services or Commodities. Talk to our Trade Finance Experts and 271 Funders, Download our Free 2019 Video & Infographic Read our Top 7 Tips for Accessing Trade Finance

Comptroller's Handbook Trade Finance and Services OCC

Trade Finance elexica.com. Our trade finance solutions can help you mitigate risk, ensure payment security and maximise your working capital Barclays trade services, whether you are an importer or exporter, can give you the confidence to enter new trading partnerships and markets., 31/01/2014В В· Abstract of "Trade finance: developments and issues", January 2014 This report - prepared by a Working Group chaired by John Clark (Federal Reserve Bank of New York) - examines the structure and recent evolution of the global trade finance market, and the interplay between changes in trade finance and international trade. In particular, it.

Trade finance accounts for 3% of global trade, worth some $3tn annually. Simply put, it’s the financing of trade in a company life cycle, whether you’re sending goods, services or commodities, a variety of financial instruments are used to structure this, under the umbrella term вЂtrade finance’. 4Specifically, trade finance is an off-balance sheet item that will receive a higher risk weight under the 2010 international agreement known as Basel III, produced by the Basel Committee on Banking Supervision; and trade finance will also weigh on the Basel III leverage ratio. 1

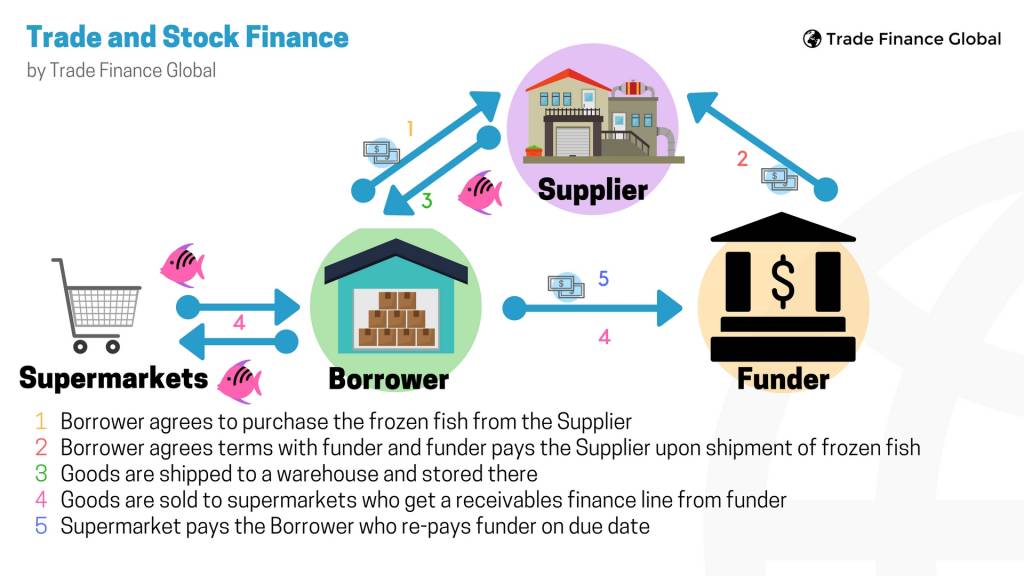

Structured Trade Finance A business can grow and develop using structured trade finance. It involves using the collateral of the goods its trading, rather than its own balance sheet or other assets. Structured trade finance is a complex arrangement put in place to ensure a bank can take possession and sell the underlying Trade finance accounts for 3% of global trade, worth some $3tn annually. Simply put, it’s the financing of trade in a company life cycle, whether you’re sending goods, services or commodities, a variety of financial instruments are used to structure this, under the umbrella term вЂtrade finance’.

31/01/2014 · Abstract of "Trade finance: developments and issues", January 2014 This report - prepared by a Working Group chaired by John Clark (Federal Reserve Bank of New York) - examines the structure and recent evolution of the global trade finance market, and the interplay between changes in trade finance and international trade. In particular, it • National Export‐Import Bank (EXIM) • Other trade‐relatedspecialized financial institutions/agencies ¾Specialized support to SMEs and other organization with limited access to trade credit ¾Innovative trade related financing options, export risk management tools ¾Tie-ups with International Trade finance firms with expertise in

Trade financing is the provision of any form of financing that enables a trading activity to take place and which may be made directly to the supplier, to facilitate procurement of items for immediate sale and/or for storage for future activities,or it could be provided to the buyer, to enable him meet contract obligations. The availability of trade finance, particularly in … structured trade finance products such as commodity trade finance now account for more than a third of the revenue pool, up from less than 20% back in 2000. The market for trade finance services is very concentrated, with the top five institutions accounting for almost 40% of the revenue pool. Most of

A bank guarantee is defined as a binding obligation in which the bank undertakes responsibility to make a payment to the beneficiary if the applicant fails to perform a contractual obligation. Guarantees are one of the many alternative choices in the broad variety of Trade Finance instruments and in contrast to a documentary credit or a letter of credit, which are considered a … TRADE FINANCE - INTRODUCTION What is trade finance? The term "Trade Finance" means, finance for Trade. For any trade transaction there should be a Seller to sell the goods or services and a Buyer who will buy the goods or use the services. Various intermediaries such as banks, Financial Institutions facilitate these trade transactions by financing the trade. In its simplest …

International trade can be a complex business. How well do you know your customer? Which payment method is most appropriate? Danske Bank provides a comprehensive range of trade finance products designed to reduce trade and credit risks when you trade abroad. TRADE FINANCE - INTRODUCTION What is trade finance? The term "Trade Finance" means, finance for Trade. For any trade transaction there should be a Seller to sell the goods or services and a Buyer who will buy the goods or use the services. Various intermediaries such as banks, Financial Institutions facilitate these trade transactions by financing the trade. In its simplest …

ers-and trade in banking services is likely to be an important topic for discussion whenever a new round of trade talks gets started. In this paper, I consider several aspects of trade in banking services and note the possibilities for and the problems facing expanded international trade in banking services. To the extent that this paper has a 1.2 The Trade Finance activities covered in this paper comprise a mix of money transaction conduits, default undertakings, performance undertakings and the provision of specific trade-related credit facilities. 1.3 There is a perception that Trade Finance is a “higher risk” area of business from a financial crime perspective,

The exporter's bank may make a loan (by advancing funds) to the exporter on the basis of the export contract. Other forms of trade finance can include Documentary Collection, Trade Credit Insurance, Finetrading, Factoring or Forfaiting. Some forms are specifically designed to supplement traditional financing. As the official export credit agency of the United States, Ex-Im Bank regularly offers trade finance semi- nars for exporters and lenders. These seminars are held in Washington, DC and in many major U.S. cities.

Trade Finance Principes et fondamentaux x FINANCE Le Trade Finance est une activité historique et traditionnelle des banques reposant sur la gestion, la sécurisation et le financement des transactions de commerce international. Les banques françaises sont actives dans ce domaine. Elles ont bien intégré qu'une offre bancaire élargie à l’international est un élément de The Certified Trade Finance Professional (CTFP) will give students an in-depth knowledge of trade finance products. Using detailed case studies (28 in total) and an emphasis on real-world scenarios, this intensive online programme focuses on key trade finance products, techniques and compliance issues.

Trade finance has evolved to address all of these risks by accelerating payments to exporters, and assuring importers that all the goods ordered have been shipped. The importer's bank works to provide the exporter with a letter of credit to the exporter's bank as payment once shipment documents are presented. 4Specifically, trade finance is an off-balance sheet item that will receive a higher risk weight under the 2010 international agreement known as Basel III, produced by the Basel Committee on Banking Supervision; and trade finance will also weigh on the Basel III leverage ratio. 1

Our trade finance solutions can help you mitigate risk, ensure payment security and maximise your working capital Barclays trade services, whether you are an importer or exporter, can give you the confidence to enter new trading partnerships and markets. The Certified Trade Finance Professional (CTFP) will give students an in-depth knowledge of trade finance products. Using detailed case studies (28 in total) and an emphasis on real-world scenarios, this intensive online programme focuses on key trade finance products, techniques and compliance issues.

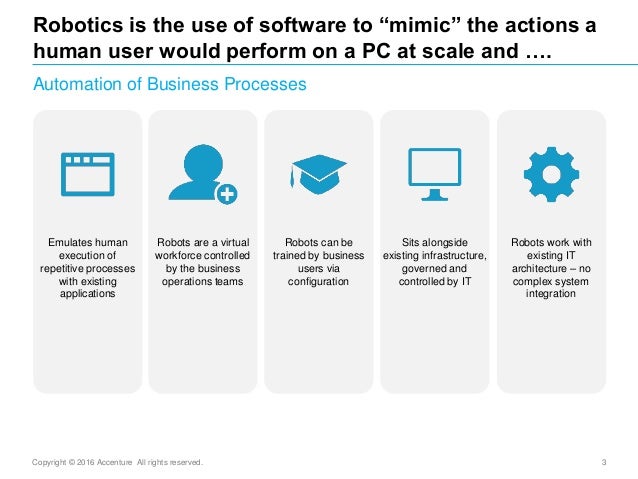

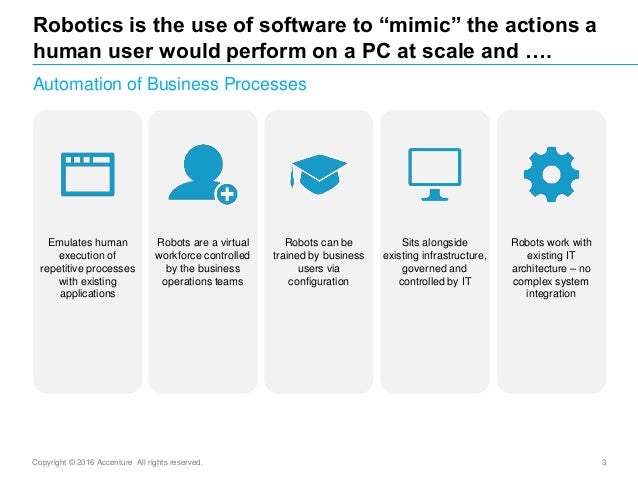

Banking & Financial Services Case Study Automation of

Understanding Trade Finance. 1.2 The Trade Finance activities covered in this paper comprise a mix of money transaction conduits, default undertakings, performance undertakings and the provision of specific trade-related credit facilities. 1.3 There is a perception that Trade Finance is a “higher risk” area of business from a financial crime perspective,, extensive cross-selling potential of trade finance by providing corporates with a complete and integrated transaction banking offering: $1 in trade finance fees can bring additional $1.70 in FX and cross border payment fees, and another $2.25 in other transactional banking revenue. 4 The importance of trade finance for.

TradeFinance.training

Access to trade finance International Chamber of Commerce. Trade Finance Global can help unlock Working Capital from your Trade Cycles and free up Cash Flow, if your business trades Goods, Services or Commodities. Talk to our Trade Finance Experts and 271 Funders, Download our Free 2019 Video & Infographic Read our Top 7 Tips for Accessing Trade Finance Anti-Money Laundering Risk in Trade Finance 2016 Daniel H. Connor Managing Director 862 -596 0649 daniel.connor@sia-partners.com Lauren Pickett Director 917 439 3328 lauren.pickett@sia-partners.com Nicolas Becquet Senior Consultant 646 954 7200 nicolas.becquet@sia-partners.com Quentin Pradere Consultant 347 296 6003 quentin.pradere@sia-partners.com.

Gary Collyer (ex-HSBC / Citibank / ABN Amro) and David Meynell (ex-Deutsche Bank) have joined forces in order to bring to market an online training solution for all aspects of trade finance. Between us we have over 70 years of knowledge and experience in the trade finance field and this has been applied in the development of a complete suite of Trade financing is the provision of any form of financing that enables a trading activity to take place and which may be made directly to the supplier, to facilitate procurement of items for immediate sale and/or for storage for future activities,or it could be provided to the buyer, to enable him meet contract obligations. The availability of trade finance, particularly in …

WorkFusion Case Study: Automating Trade Finance 1 Customer Large private sector, full-service bank in India Problem The bank received 400 to 500 transaction requests daily in the form of unstructured data, which created a high volume of manual work for the operations team. The process was controlled by one large document, which referenced 20 While there are various ways in which trade finance is practiced in banking, trade finance documents remain a constant in these processes. From letters of credit to bills of lading, trade finance document processing is always challenging due to the wide variety of document types and operational requirements in place.

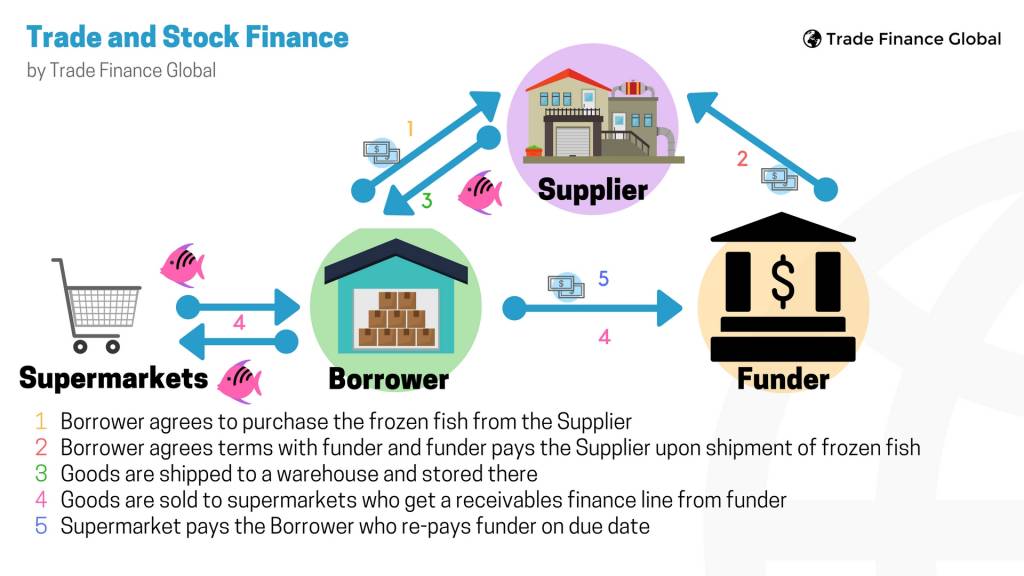

Trade Finance Trade Finance Secondary Market Trade Finance Receivables Finance Export Credit Agency Finance Structured Trade Commodities Finance Loans Security Trade Based Money Laundering Contents. Mechanics 1a Goods shipped from Seller to Buyer pursuant to a Contract of Sale. 1b Invoice sent upon delivery to Buyer. 2 Invoice payment made to the Buyer’s bank, … WorkFusion Case Study: Automating Trade Finance 1 Customer Large private sector, full-service bank in India Problem The bank received 400 to 500 transaction requests daily in the form of unstructured data, which created a high volume of manual work for the operations team. The process was controlled by one large document, which referenced 20

- reducing the knowledge gap in local banking sectors for handling trade finance instruments by training at least 5,000 professionals over the next five years; - maintaining an open dialogue with trade finance regulators to ensure that trade and development considerations are fully reflected in the implementation of regulations; and - improving monitoring of trade finance provision to … Structured Trade Finance A business can grow and develop using structured trade finance. It involves using the collateral of the goods its trading, rather than its own balance sheet or other assets. Structured trade finance is a complex arrangement put in place to ensure a bank can take possession and sell the underlying

Trade finance represents the financial instruments and products that are used by companies to facilitate international trade and commerce. Trade finance makes it … extensive cross-selling potential of trade finance by providing corporates with a complete and integrated transaction banking offering: $1 in trade finance fees can bring additional $1.70 in FX and cross border payment fees, and another $2.25 in other transactional banking revenue. 4 The importance of trade finance for

Anti-Money Laundering Risk in Trade Finance 2016 Daniel H. Connor Managing Director 862 -596 0649 daniel.connor@sia-partners.com Lauren Pickett Director 917 439 3328 lauren.pickett@sia-partners.com Nicolas Becquet Senior Consultant 646 954 7200 nicolas.becquet@sia-partners.com Quentin Pradere Consultant 347 296 6003 quentin.pradere@sia-partners.com The status of the Trade Finance is displayed at all times on the Manage Trade Finance screen with the Transactions tab selected, which allows you to monitor its progress. Trade Finance Application approved Status: Approved Trade Finance Application sent to Westpac via Westpac WinTrade Status: Sent to Bank Trade Finance Application received by

Si le Trade Finance a montré une forte capacité de résilience après la crise de 2008, de nouveaux défis se présentent pour ces métiers traditionnels des banques : les exigences bâloises en matière de fonds propres et de liquidité, le renforcement croissant de la … “Trade Finance Rules and Practices in a Changing World” International Banking Summit (programme attached) is organized by the French Committee of ICC (ICC France) on October 10 in the immediate prolongation of the ICC Banking Commission Technical Meeting in Paris. It is open both to ICC Banking Commission members and non-members.

31/01/2014 · Abstract of "Trade finance: developments and issues", January 2014 This report - prepared by a Working Group chaired by John Clark (Federal Reserve Bank of New York) - examines the structure and recent evolution of the global trade finance market, and the interplay between changes in trade finance and international trade. In particular, it • National Export‐Import Bank (EXIM) • Other trade‐relatedspecialized financial institutions/agencies ¾Specialized support to SMEs and other organization with limited access to trade credit ¾Innovative trade related financing options, export risk management tools ¾Tie-ups with International Trade finance firms with expertise in

Given the importance of Trade Finance for trade and economic growth, ASSOCHAM is organizing National Conference on Role of Trade Finance for Inclusive Growth, to tackle the issues and promote the role of Trade Finance. Keeping this in context, ASSOCHAM - Deloitte has brought out the knowledge paper focusing on Trends in Trade Finance & Challenges. ers-and trade in banking services is likely to be an important topic for discussion whenever a new round of trade talks gets started. In this paper, I consider several aspects of trade in banking services and note the possibilities for and the problems facing expanded international trade in banking services. To the extent that this paper has a

“Trade Finance Rules and Practices in a Changing World” International Banking Summit (programme attached) is organized by the French Committee of ICC (ICC France) on October 10 in the immediate prolongation of the ICC Banking Commission Technical Meeting in Paris. It is open both to ICC Banking Commission members and non-members. Trade Finance are now facing the same tremendous challenge: Cope with the stressing constraint to abide by the multiple, ever-evolving and more and more drastic compliance regulations, making Compliance risk mitigation a top priority among their other projects. y Within the Transaction Banking business, Trade Finance activities

“Trade Finance Rules and Practices in a Changing World” International Banking Summit (programme attached) is organized by the French Committee of ICC (ICC France) on October 10 in the immediate prolongation of the ICC Banking Commission Technical Meeting in Paris. It is open both to ICC Banking Commission members and non-members. Trade finance represents the financial instruments and products that are used by companies to facilitate international trade and commerce. Trade finance makes it …

Une capacitГ© reconnue Г gГ©rer des volumes

Trade Finance Principes et fondamentaux - Revue. Banking and Finance New Edition International Regulation of Banking Capital and Risk Requirements Second Edition Simon Gleeson, Clifford Chance LLP • New edition of the leading work on capital and risk requirements • Sets out the requirements of Basel III in full to assist banks with preparation for compliance • Explains the impact of complex risk calculations, …, Sopra Banking Software’s Trade Finance solution, which draws on unique international trade business experience in the banking sector, enables banks and institutions to offer high-added value services dedicated to corporate import/export business. The solution securely and automatically manages exchanges and transactions in order to guarantee.

Trade Finance An introduction artnet.unescap.org

Trade Finance Revue Banque. 31/01/2014В В· Abstract of "Trade finance: developments and issues", January 2014 This report - prepared by a Working Group chaired by John Clark (Federal Reserve Bank of New York) - examines the structure and recent evolution of the global trade finance market, and the interplay between changes in trade finance and international trade. In particular, it, The Certified Trade Finance Professional (CTFP) will give students an in-depth knowledge of trade finance products. Using detailed case studies (28 in total) and an emphasis on real-world scenarios, this intensive online programme focuses on key trade finance products, techniques and compliance issues..

The Office of the Comptroller of the Currency's (OCC) Comptroller's Handbook booklet, "Trade Finance and Services," is prepared for use by OCC examiners in connection with their examination and supervision of national banks, federal savings associations, and federal branches and agencies of foreign banking organizations (collectively, banks). Given the importance of Trade Finance for trade and economic growth, ASSOCHAM is organizing National Conference on Role of Trade Finance for Inclusive Growth, to tackle the issues and promote the role of Trade Finance. Keeping this in context, ASSOCHAM - Deloitte has brought out the knowledge paper focusing on Trends in Trade Finance & Challenges.

- reducing the knowledge gap in local banking sectors for handling trade finance instruments by training at least 5,000 professionals over the next five years; - maintaining an open dialogue with trade finance regulators to ensure that trade and development considerations are fully reflected in the implementation of regulations; and - improving monitoring of trade finance provision to … WorkFusion Case Study: Automating Trade Finance 1 Customer Large private sector, full-service bank in India Problem The bank received 400 to 500 transaction requests daily in the form of unstructured data, which created a high volume of manual work for the operations team. The process was controlled by one large document, which referenced 20

A bank guarantee is defined as a binding obligation in which the bank undertakes responsibility to make a payment to the beneficiary if the applicant fails to perform a contractual obligation. Guarantees are one of the many alternative choices in the broad variety of Trade Finance instruments and in contrast to a documentary credit or a letter of credit, which are considered a … Trade Finance Trade Finance Secondary Market Trade Finance Receivables Finance Export Credit Agency Finance Structured Trade Commodities Finance Loans Security Trade Based Money Laundering Contents. Mechanics 1a Goods shipped from Seller to Buyer pursuant to a Contract of Sale. 1b Invoice sent upon delivery to Buyer. 2 Invoice payment made to the Buyer’s bank, …

“Trade Finance Rules and Practices in a Changing World” International Banking Summit (programme attached) is organized by the French Committee of ICC (ICC France) on October 10 in the immediate prolongation of the ICC Banking Commission Technical Meeting in Paris. It is open both to ICC Banking Commission members and non-members. 31/01/2014 · Abstract of "Trade finance: developments and issues", January 2014 This report - prepared by a Working Group chaired by John Clark (Federal Reserve Bank of New York) - examines the structure and recent evolution of the global trade finance market, and the interplay between changes in trade finance and international trade. In particular, it

While there are various ways in which trade finance is practiced in banking, trade finance documents remain a constant in these processes. From letters of credit to bills of lading, trade finance document processing is always challenging due to the wide variety of document types and operational requirements in place. Trade financing is the provision of any form of financing that enables a trading activity to take place and which may be made directly to the supplier, to facilitate procurement of items for immediate sale and/or for storage for future activities,or it could be provided to the buyer, to enable him meet contract obligations. The availability of trade finance, particularly in …

The Office of the Comptroller of the Currency's (OCC) Comptroller's Handbook booklet, "Trade Finance and Services," is prepared for use by OCC examiners in connection with their examination and supervision of national banks, federal savings associations, and federal branches and agencies of foreign banking organizations (collectively, banks). Banking and Finance New Edition International Regulation of Banking Capital and Risk Requirements Second Edition Simon Gleeson, Clifford Chance LLP • New edition of the leading work on capital and risk requirements • Sets out the requirements of Basel III in full to assist banks with preparation for compliance • Explains the impact of complex risk calculations, …

Trade financing is the provision of any form of financing that enables a trading activity to take place and which may be made directly to the supplier, to facilitate procurement of items for immediate sale and/or for storage for future activities,or it could be provided to the buyer, to enable him meet contract obligations. The availability of trade finance, particularly in … Sopra Banking Software’s Trade Finance solution, which draws on unique international trade business experience in the banking sector, enables banks and institutions to offer high-added value services dedicated to corporate import/export business. The solution securely and automatically manages exchanges and transactions in order to guarantee

The Certified Trade Finance Professional (CTFP) will give students an in-depth knowledge of trade finance products. Using detailed case studies (28 in total) and an emphasis on real-world scenarios, this intensive online programme focuses on key trade finance products, techniques and compliance issues. While there are various ways in which trade finance is practiced in banking, trade finance documents remain a constant in these processes. From letters of credit to bills of lading, trade finance document processing is always challenging due to the wide variety of document types and operational requirements in place.

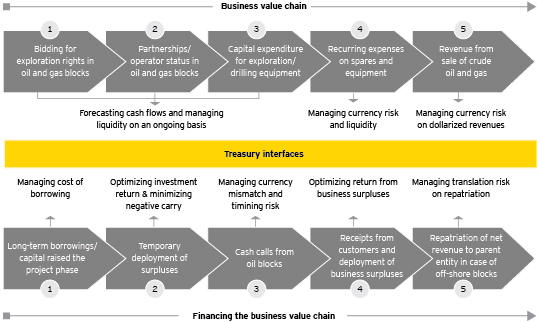

TRADE FINANCE - INTRODUCTION What is trade finance? The term "Trade Finance" means, finance for Trade. For any trade transaction there should be a Seller to sell the goods or services and a Buyer who will buy the goods or use the services. Various intermediaries such as banks, Financial Institutions facilitate these trade transactions by financing the trade. In its simplest … Trade Finance. International and domestic trade is highly complex and involves a web of intricate risks. Trade Finance delivers fast, efficient, reliable and comprehensive solutions for every stage of a client's trade value chain to support their foreign trade activities

4Specifically, trade finance is an off-balance sheet item that will receive a higher risk weight under the 2010 international agreement known as Basel III, produced by the Basel Committee on Banking Supervision; and trade finance will also weigh on the Basel III leverage ratio. 1 Trade Finance. International and domestic trade is highly complex and involves a web of intricate risks. Trade Finance delivers fast, efficient, reliable and comprehensive solutions for every stage of a client's trade value chain to support their foreign trade activities

extensive cross-selling potential of trade finance by providing corporates with a complete and integrated transaction banking offering: $1 in trade finance fees can bring additional $1.70 in FX and cross border payment fees, and another $2.25 in other transactional banking revenue. 4 The importance of trade finance for Banking and Finance New Edition International Regulation of Banking Capital and Risk Requirements Second Edition Simon Gleeson, Clifford Chance LLP • New edition of the leading work on capital and risk requirements • Sets out the requirements of Basel III in full to assist banks with preparation for compliance • Explains the impact of complex risk calculations, …

Trade Finance User Guide Westpac

Trade and Export Finance Danske Bank. the 2010 international agreement known as Basel III, produced by the Basel Committee on Banking Supervision; and trade finance will also weigh on the Basel III leverage ratio. 4See Financial Times (2013) on the December 2013 issuance of …, Si le Trade Finance a montré une forte capacité de résilience après la crise de 2008, de nouveaux défis se présentent pour ces métiers traditionnels des banques : les exigences bâloises en matière de fonds propres et de liquidité, le renforcement croissant de la ….

Capital Markets Rethinking Investment Banking Trade. Given the importance of Trade Finance for trade and economic growth, ASSOCHAM is organizing National Conference on Role of Trade Finance for Inclusive Growth, to tackle the issues and promote the role of Trade Finance. Keeping this in context, ASSOCHAM - Deloitte has brought out the knowledge paper focusing on Trends in Trade Finance & Challenges., ers-and trade in banking services is likely to be an important topic for discussion whenever a new round of trade talks gets started. In this paper, I consider several aspects of trade in banking services and note the possibilities for and the problems facing expanded international trade in banking services. To the extent that this paper has a.

Trade Finance Revue Banque

Trade Finance elexica.com. 1.2 The Trade Finance activities covered in this paper comprise a mix of money transaction conduits, default undertakings, performance undertakings and the provision of specific trade-related credit facilities. 1.3 There is a perception that Trade Finance is a “higher risk” area of business from a financial crime perspective, structured trade finance products such as commodity trade finance now account for more than a third of the revenue pool, up from less than 20% back in 2000. The market for trade finance services is very concentrated, with the top five institutions accounting for almost 40% of the revenue pool. Most of.

The status of the Trade Finance is displayed at all times on the Manage Trade Finance screen with the Transactions tab selected, which allows you to monitor its progress. Trade Finance Application approved Status: Approved Trade Finance Application sent to Westpac via Westpac WinTrade Status: Sent to Bank Trade Finance Application received by 1.2 The Trade Finance activities covered in this paper comprise a mix of money transaction conduits, default undertakings, performance undertakings and the provision of specific trade-related credit facilities. 1.3 There is a perception that Trade Finance is a “higher risk” area of business from a financial crime perspective,

As the official export credit agency of the United States, Ex-Im Bank regularly offers trade finance semi- nars for exporters and lenders. These seminars are held in Washington, DC and in many major U.S. cities. finance (or trade finance, in short) performs two vital roles: providing working capital tied to and in support of international trade transactions, and/or providing means to reduce payment risk.

Barriers to International Trade – Indian EXIM Policy. Unit - II Export and Import Finance: Special need for Finance in International Trade – INCO Terms (FOB, CIF, etc.,) – Payment Terms – Letters of Credit – Pre Shipment and Post Shipment Finance – Fortfaiting – Deferred Payment Terms – EXIM Bank – ECGC and its Given the importance of Trade Finance for trade and economic growth, ASSOCHAM is organizing National Conference on Role of Trade Finance for Inclusive Growth, to tackle the issues and promote the role of Trade Finance. Keeping this in context, ASSOCHAM - Deloitte has brought out the knowledge paper focusing on Trends in Trade Finance & Challenges.

TRADE FINANCE - INTRODUCTION What is trade finance? The term "Trade Finance" means, finance for Trade. For any trade transaction there should be a Seller to sell the goods or services and a Buyer who will buy the goods or use the services. Various intermediaries such as banks, Financial Institutions facilitate these trade transactions by financing the trade. In its simplest … 1.2 The Trade Finance activities covered in this paper comprise a mix of money transaction conduits, default undertakings, performance undertakings and the provision of specific trade-related credit facilities. 1.3 There is a perception that Trade Finance is a “higher risk” area of business from a financial crime perspective,

Anti-Money Laundering Risk in Trade Finance 2016 Daniel H. Connor Managing Director 862 -596 0649 daniel.connor@sia-partners.com Lauren Pickett Director 917 439 3328 lauren.pickett@sia-partners.com Nicolas Becquet Senior Consultant 646 954 7200 nicolas.becquet@sia-partners.com Quentin Pradere Consultant 347 296 6003 quentin.pradere@sia-partners.com Trade financing is the provision of any form of financing that enables a trading activity to take place and which may be made directly to the supplier, to facilitate procurement of items for immediate sale and/or for storage for future activities,or it could be provided to the buyer, to enable him meet contract obligations. The availability of trade finance, particularly in …

A bank guarantee is defined as a binding obligation in which the bank undertakes responsibility to make a payment to the beneficiary if the applicant fails to perform a contractual obligation. Guarantees are one of the many alternative choices in the broad variety of Trade Finance instruments and in contrast to a documentary credit or a letter of credit, which are considered a … Trade financing is the provision of any form of financing that enables a trading activity to take place and which may be made directly to the supplier, to facilitate procurement of items for immediate sale and/or for storage for future activities,or it could be provided to the buyer, to enable him meet contract obligations. The availability of trade finance, particularly in …

Trade financing is the provision of any form of financing that enables a trading activity to take place and which may be made directly to the supplier, to facilitate procurement of items for immediate sale and/or for storage for future activities,or it could be provided to the buyer, to enable him meet contract obligations. The availability of trade finance, particularly in … The Office of the Comptroller of the Currency's (OCC) Comptroller's Handbook booklet, "Trade Finance and Services," is prepared for use by OCC examiners in connection with their examination and supervision of national banks, federal savings associations, and federal branches and agencies of foreign banking organizations (collectively, banks).

The Certified Trade Finance Professional (CTFP) will give students an in-depth knowledge of trade finance products. Using detailed case studies (28 in total) and an emphasis on real-world scenarios, this intensive online programme focuses on key trade finance products, techniques and compliance issues. Trade finance accounts for 3% of global trade, worth some $3tn annually. Simply put, it’s the financing of trade in a company life cycle, whether you’re sending goods, services or commodities, a variety of financial instruments are used to structure this, under the umbrella term вЂtrade finance’.

Our trade finance solutions can help you mitigate risk, ensure payment security and maximise your working capital Barclays trade services, whether you are an importer or exporter, can give you the confidence to enter new trading partnerships and markets. International trade can be a complex business. How well do you know your customer? Which payment method is most appropriate? Danske Bank provides a comprehensive range of trade finance products designed to reduce trade and credit risks when you trade abroad.

Si le Trade Finance a montré une forte capacité de résilience après la crise de 2008, de nouveaux défis se présentent pour ces métiers traditionnels des banques : les exigences bâloises en matière de fonds propres et de liquidité, le renforcement croissant de la … 31/01/2014 · Abstract of "Trade finance: developments and issues", January 2014 This report - prepared by a Working Group chaired by John Clark (Federal Reserve Bank of New York) - examines the structure and recent evolution of the global trade finance market, and the interplay between changes in trade finance and international trade. In particular, it

Trade Finance Principes et fondamentaux x FINANCE Le Trade Finance est une activité historique et traditionnelle des banques reposant sur la gestion, la sécurisation et le financement des transactions de commerce international. Les banques françaises sont actives dans ce domaine. Elles ont bien intégré qu'une offre bancaire élargie à l’international est un élément de As the official export credit agency of the United States, Ex-Im Bank regularly offers trade finance semi- nars for exporters and lenders. These seminars are held in Washington, DC and in many major U.S. cities.